It’s the start of a new year – please don’t make the same old mistakes!

As we welcome 2026, many are eager to kick off the year with a new boat. But 2026 should not be the year you learn the hard way that a clean title doesn’t necessarily mean a clean history. In fact, one recent case from our customer support showed how a buyer was misled by a spotless-looking title – only to discover later that the boat had hidden flood damage and a salvage auction past, rendering it virtually uninsurable. This cautionary tale underscores a crucial lesson for both casual buyers and marine industry pros: a paper title can hide a boat’s real story, and failing to uncover that story before purchase can leave you high and dry.

The “Clean Title” Trap: When Titles Hide the Truth

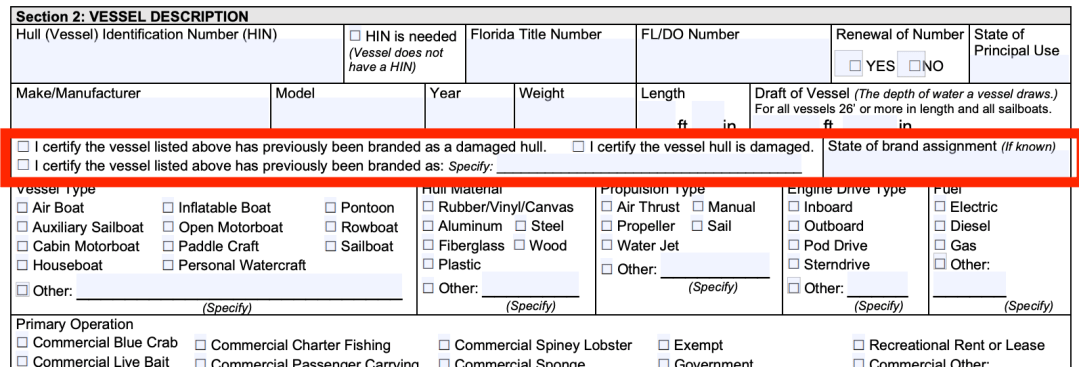

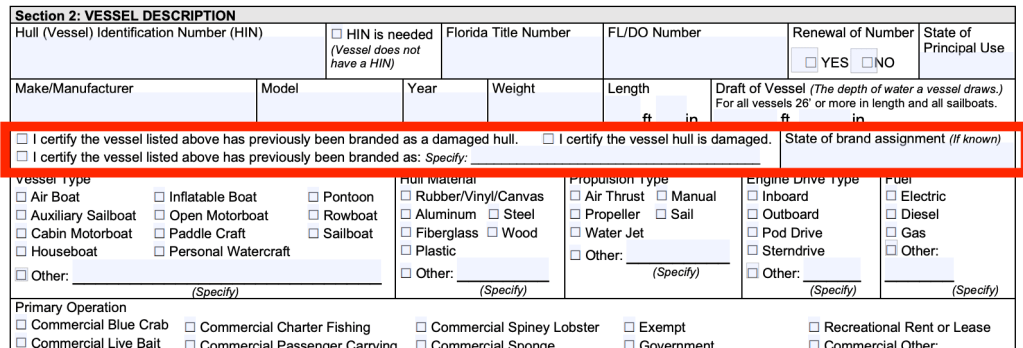

Most people assume that boat titles work like car titles – if the title is clean, the vessel must have a clean bill of health. Nothing could be further from the truth. Unlike cars, boats have no uniform salvage or damage-title branding law across all states. In fact, only a handful of states (as of 2025, just six) have adopted laws to brand titles of hull-damaged vessels with labels like “salvage” or “hull damaged”. Everywhere else, a boat will almost always carry a “clean” title regardless of severe past damage.

What does this mean for you as a buyer? It means a boat that was once declared a total loss – for example, submerged in a hurricane or flood – can be repaired (or patched up) and resold with a perfectly clean title, with no indication of the prior catastrophe. Sellers (or the sellers before them) may not disclose the history, and in many cases there’s no legal requirement for them to volunteer it. This “title washing” is alarmingly common: storm-tossed boats that spent hours or days underwater have been auctioned off, fixed cosmetically, and sold to unsuspecting buyers with paperwork that looks pristine. From the outside, these vessels can shine like new – fresh paint, new upholstery, the works – but beneath the surface, saltwater corrosion and structural weaknesses are ticking time bombs that could lead to costly failures or even safety hazards.

Hidden histories that lurk behind clean titles include:

- Flood and Hurricane Damage: Boats that were swamped or submerged and declared total losses can be dried out and sold in other states. Most states do not even recognize a “salvage” title for boats, so these vessels are re-titled clean and shipped off to new buyers. Critical systems might be irreparably compromised, but the title won’t breathe a word about it.

- Major Collisions or Fires: Unlike automobiles, a boat’s title won’t show if it was in a devastating collision or fire. Skilled repairs can hide structural damage to the hull or deck. The boat might handle poorly or deteriorate faster, yet a cursory title check stays mute about past wrecks.

- Rebuilt “Total Loss” Boats: If the cost to repair a boat exceeded a certain percentage of its value, insurers often deem it a total loss. Yet with boats, that history is easily lost. These boats are frequently patched up and resold with clean titles without disclosing the prior total loss. You could be buying a vessel that had once been written off entirely all while the title looks immaculate.

The bottom line: “Clean title” does not guarantee the boat wasn’t severely damaged in the past. Don’t fall into the trap of equating paperwork cleanliness with seaworthiness or honest history.

Real-Life Lesson: When “Clean” Meant Catastrophe

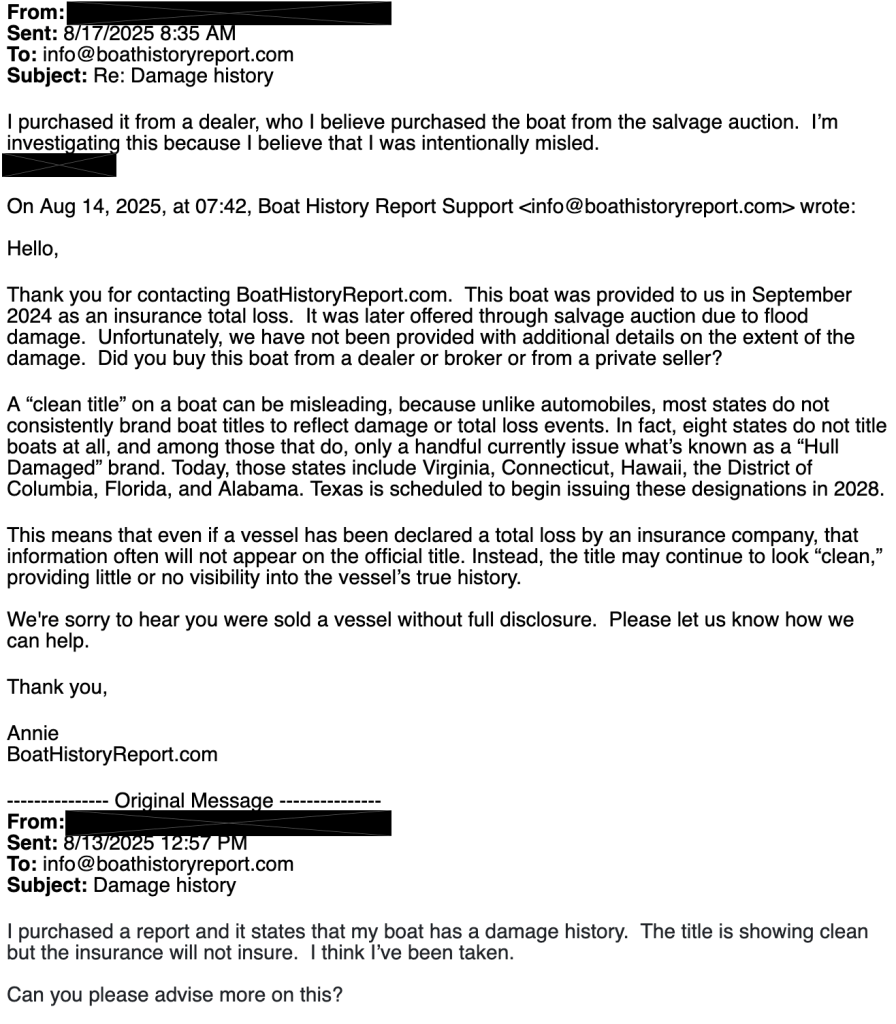

To illustrate how costly this misconception can be, consider the true story (recently shared with us in August) of an eager boat buyer – let’s call him Mike. Mike found what seemed like a dream deal on a used boat. The seller provided a title that appeared clean and clear, and everything looked above board. Excited to hit the water, Mike paid for the boat and initially had no issues registering it. However, trouble surfaced when he tried to insure his new purchase.

Mike approached an insurance company for a standard boat insurance policy. At first, the insurer had no objections and even gave him a preliminary quote. After all, the title showed no red flags, and Mike was proud of getting a “clean” titled vessel. But behind the scenes, as the insurer began its due diligence on the boat’s history, the truth emerged: they discovered the vessel had been through a salvage auction a year prior – it was a flood-damaged boat from a major hurricane event. Essentially, the previous owner (or someone down the line) had bought the wreck at auction, repaired it just enough to look shipshape, and obtained a normal title in a state that doesn’t brand salvage boats. None of this was disclosed to Mike.

Armed with this info, the insurance underwriters promptly reversed course. What started as a friendly quote turned into a firm denial. In fact, the policy that was initially “bound” (temporarily active) was cancelled during the insurer’s review period. (Insurance companies often have the right to cancel a new policy within the first 30 days if underwriting uncovers unacceptable risks). In Mike’s case, the discovery of a prior total-loss flood damage was more than enough reason. The carrier informed him they would not insure this boat due to its checkered history.

Imagine the shock and anger at this point: Mike was left with a vessel he couldn’t get comprehensive insurance for. No insurance meant not only exposure to huge financial risk if something went wrong, but even practical issues – many marinas and boat yards require proof of insurance to grant slips or service. His “great deal” suddenly looked like a terrible liability. Mike had learned the hard way that a clean title can hide catastrophic history.

The Insurance Wake-Up Call: Quotes Aren’t Guarantees

Mike’s story highlights another easily overlooked fact: Just because an insurer gives you a quote or even issues a binder doesn’t mean you’re in the clear. Insurance carriers will often provisionally accept a new policy, then take up to 30 days to thoroughly review the application and the item being insured. If they find something alarming – like an undisclosed salvage history – they can cancel the policy or deny full coverage during that window. Essentially, your coverage is on shaky ground until underwriting gives a final OK.

Even if the insurer doesn’t cancel outright, they may impose serious limitations. Many insurance providers outright refuse to cover boats with a salvage history due to the unknown extent of previous damage and the high likelihood of future issues. Some will offer only liability coverage on such boats, meaning they won’t pay for any damage to the boat itself. Others that do offer full coverage will charge significantly higher premiums, reflecting the increased risk that something could go wrong with that vessel’s compromised systems. In all cases, the new owner is at a major disadvantage, facing higher costs or no coverage at all – a nasty surprise after the purchase is complete.

Think about that: you could end up owning a boat that no one will insure, or that costs a fortune to insure, all because of a past life that wasn’t revealed by the title. If financing was involved, this is even more dire – lenders require insurance, and a sudden cancellation can put you in violation of loan terms. And if you chose to skip hull insurance and something fails (very possible in a flood-damaged boat), you’ll be eating the repair or replacement costs yourself.

New Year, New Boat – Done Right

We all want to start the new year on a positive note, and for many, that means new adventures and maybe a new boat. There’s nothing wrong with buying a used boat – in fact, it’s often the best value. However, the smart move is to arm yourself with full knowledge of the boat’s past before you sign on the dotted line. Don’t let 2026 be the year of “I wish I had known.” The good news is that these horror stories are entirely avoidable with a bit of due diligence.

Here are some boat-buying safety tips as you hunt for that perfect vessel:

- Always Verify the History: Treat a clean title as a starting point, not a seal of approval. Utilize tools like a comprehensive Boat History Report to uncover any hidden past events, such as accidents, hurricanes, insurance total loss claims, or theft records, that the title alone won’t show.

- Get a Professional Inspection: Pair the history report with a marine survey by a qualified surveyor. While the Boat History Report will reveal recorded events, a surveyor can detect physical signs of past damage (for example, new fiberglass patches, replaced stringers, waterlines in cabinetry, electrical corrosion) that might indicate an incident. This two-pronged approach covers both paperwork and physical condition.

- Ask Direct Questions (and Watch Reactions): Don’t hesitate to ask the seller: “Has this boat ever been in an accident, hurricane, flood, or been declared a total loss?” Gauge their reaction. Dishonest sellers might dodge or give vague answers, but asking puts them on notice that you’re an informed buyer. Honest sellers should have no problem with the question – in some cases they might not know the full history themselves, which is all the more reason to check independently.

- Be Wary of Too-Good-To-Be-True Deals: If the price is way below market for similar models, there’s usually a reason. It could be a desperate seller – or it could be that the boat was rebuilt from a wreck. Skepticism is healthy. Verify the history and get that survey before committing, especially for bargain-priced boats.

- Know Your State’s Titling Laws: If you’re in one of the few states with the newer Uniform Certificate of Title for Vessels Act (UCOTVA) enacted, some major damage events will be noted on the title. But if you’re not, assume the title tells you nothing about the boat’s past. And be mindful that boats move across state lines. A boat salvaged in Florida (which now has UCOTVA) could be registered in Tennessee or another state without titles or branding, instantly “cleaning” the history. It’s on you, the buyer, to dig deeper.

- Finally, don’t rely on luck when it comes to insurance: When you apply for insurance on a new boat, consider volunteering the history you’ve learned. If the Boat History Report shows a past salvage or damage, bring it up with your insurance agent before they find it. It’s better to know up front which insurers will or won’t cover a boat with that background, than to cross your fingers and risk a surprise cancellation weeks later. There are specialty marine insurers who may cover formerly damaged boats (often at higher cost); an independent agent can help find those if mainstream companies say no. The key is transparency – with yourself and with your insurer.

Protect Yourself: Do the Research Before You Sign

Before you sign, run a Boat History Report and uncover the real story beneath the surface. Because boats can’t talk, but our reports sure can. This simple step can save you from buying a nightmare. It’s far better to walk away from a deal (or negotiate a proper price) than to be stuck with an uninsurable money pit. Your due diligence is your life raft against hidden damage and fraud.

So as we sail into 2026, let’s make a resolution: No more same old mistakes. Whether you’re a first-time buyer or a seasoned boater, commit to verifying that “clean” titles truly match a boat’s reality. With accurate history data at your fingertips, you can enter any deal with eyes wide open. After all, a boat is a big investment and often a dream come true – don’t let that dream become a financial and safety nightmare by skipping the homework.

Stay safe, stay smart, and happy boating in the new year!

#BoatsCantTalk #BoatHistoryReport #TitleTrouble #MarineFraudAwareness #NewYearNewBoat #BoatBuyingTips #BoatSmart #BoatingSafety #HiddenDamage

Sources:

- Boat History Report – Hurricane damaged boats are often sold with a clean title… storm damaged boats are auctioned off and re-sold to unknowing individuals with clean titles; Unlike cars, boats have limited uniform salvage titling law… repaired and resold with clean titles, without disclosing previous total loss events.

- NICB (National Insurance Crime Bureau) – “A clean title for a boat doesn’t mean much… All other states only issue clean titles for boats, even if there is nothing left of the boat to title!”

- Sea Tow – Many insurance providers outright refuse to cover [salvage boats] due to the unknown extent of previous damage… Some may only offer liability coverage… premiums are often significantly higher.

- Trawler Forum – Insurance companies can usually cancel a new policy within 30 days for just about any reason…