Across the marine industry, we are seeing a noticeable increase in fraud tied to boat purchase transactions. Online marketplaces, interstate sales, and remote closings have made buying and selling more convenient, but they have also created new opportunities for bad actors. In recent months, more buyers have reported fraudulent listings, deposit theft, title misrepresentation, and payment diversion schemes.

Because of this surge, it is important to provide clear guidance to prospective boat buyers on how to recognize warning signs and reduce risk. Most marine professionals operate ethically, but purchase related fraud does occur, particularly in private party transactions and online listings. Understanding where buyers are most vulnerable, and how to protect yourself before and during the transaction, is essential before any money changes hands.

This article focuses exclusively on fraud that occurs prior to closing and during the purchase process, along with practical steps buyers can take to prevent and avoid it.

Buying a boat is an exciting milestone. It is also a financial transaction that often involves large deposits, wire transfers, financing documents, and multiple third parties. Wherever significant funds move, fraud can follow.

Most marine professionals operate ethically. However, purchase related fraud does occur, particularly in private party transactions and online listings. Understanding where buyers are most vulnerable, and how to reduce that risk, is essential before any money changes hands.

Why Boat Purchases Are Attractive to Fraudsters

Boat transactions present unique characteristics that make them appealing targets:

- High dollar values

- Interstate or international buyers and sellers

- Complex title and registration systems

- Limited centralized documentation in some jurisdictions

- Buyers who may not be local to the vessel

These factors create opportunity for misrepresentation, identity fraud, and financial scams.

Fraud Before You Even See the Boat

Fake Listings

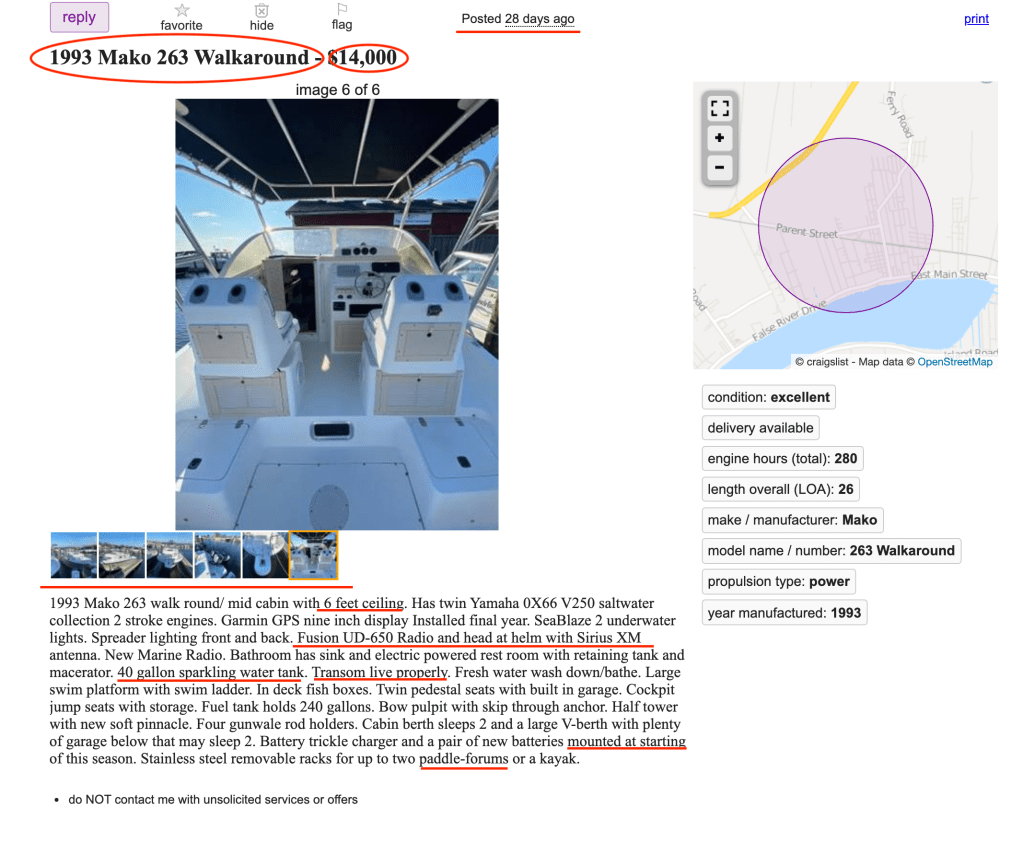

One of the most common pre purchase scams involves fraudulent listings. Scammers copy legitimate listings, including photos and specifications, then repost them at a below market price to generate urgency.

Warning signs include:

- A price significantly below comparable vessels

- Refusal to allow an in person showing

- Requests for deposits before inspection

- Claims that the boat is located overseas or in storage

Before engaging seriously, verify the vessel’s Hull Identification Number and run a Boat History Report. If the seller cannot provide a valid HIN that matches documentation and history records, that is an immediate red flag.

Impersonation of Legitimate Owners, Dealers, or Brokers

Fraudsters may pose as brokers or as representatives of the registered owner. They often communicate exclusively by email and discourage direct phone calls.

A Boat History Report helps confirm ownership history and registration records associated with the vessel. If the person claiming to sell the boat cannot reasonably explain their relationship to the documented ownership history, pause the transaction.

Fraud During the Purchase Process

Deposit Theft

Deposits are typically held in escrow under written contract terms. Fraud occurs when funds are sent directly to an individual who lacks authority to sell the vessel or who disappears after receipt.

Best practices include:

- Never wiring funds to a personal account without independent verification

- Confirming escrow details directly with an established brokerage or title company

- Matching the seller’s identity to documented ownership history

A Boat History Report provides ownership timelines and registration data that help validate whether the seller’s story aligns with recorded information.

Title and Lien Misrepresentation

Unlike real estate, boat title systems vary by state and by federal documentation status. Fraud can occur when:

- A seller conceals an outstanding lien

- Title branding such as salvage or rebuilt status is not disclosed

- The vessel was previously declared a total loss

- Ownership transfers were not properly completed

A Boat History Report compiles available registration/title/documentation records, title branding, and damage history. Reviewing this information before closing reduces the likelihood of inheriting unresolved financial obligations or diminished value.

Vessel Identity Fraud

Hull Identification Numbers can be altered, removed, or mismatched with paperwork. In some cases, a stolen vessel is assigned documentation from a similar legitimate boat.

Buyers should:

• Physically inspect the HIN on the vessel

• Confirm it matches all registration and title documents

• Cross reference it with a Boat History Report

If the report reveals inconsistencies in state registration, length, manufacturer details, or serial data, further investigation is warranted before proceeding.

Damage and Total Loss Concealment

Not all prior damage is visible during a showing. Boats that have experienced grounding, fire, flooding, or hurricane damage may be cosmetically repaired before listing.

Failure to disclose prior damage is a form of fraud when done intentionally to inflate value.

A Boat History Report may reveal:

• Reported accident records

• Insurance total loss events

• Salvage or rebuilt branding

• Theft recoveries

This information allows buyers to ask informed questions and ensures the marine survey focuses on areas associated with historical damage.

Survey Manipulation

The marine survey is a critical protective step, but it must be independent. Buyers should hire their own accredited surveyor rather than relying solely on referrals from the seller.

Reviewing a Boat History Report prior to the survey gives the surveyor context about prior incidents, ownership transfers, or title events that may influence inspection focus.

Payment and Escrow Scams

Financial fraud often escalates near closing. Common schemes include:

- Fake cashier’s checks that later fail to clear

- Overpayment scams requesting a refund of excess funds

- Fraudulent escrow companies with convincing websites

- Spoofed wiring instructions sent by email

To reduce exposure:

- Confirm wiring instructions verbally using verified contact information

- Use established escrow services or reputable broker trust accounts

- Avoid rushing closing due to artificial deadlines

The Role of a Boat History Report in Fraud Prevention

A Boat History Report is not a substitute for a survey, sea trial, or legal review. It is a foundational due diligence tool used at the beginning of serious negotiations.

It provides:

- Ownership and registration history

- Title branding information

- Reported accident and damage records

- Theft records

- Recall data

- Data inconsistencies across jurisdictions

By reviewing this information early, buyers can:

- Confirm the vessel’s identity

- Validate the seller’s claims

- Identify red flags before wiring funds

- Strengthen negotiations based on documented history

In many cases, fraud relies on buyers skipping basic verification steps. A Boat History Report introduces objective, third party data into the transaction before financial exposure increases.

Best Practices Before Closing

Before finalizing a purchase:

- Obtain and review a Boat History Report

- Hire an independent accredited surveyor

- Verify the Hull Identification Number physically and on all documents

- Confirm escrow arrangements independently

- Review title and lien documentation carefully

- Avoid transactions that involve unexplained urgency

A legitimate seller or broker will support thorough due diligence. Resistance to reasonable verification is a warning sign.

Boat purchases should be exciting, not risky. Fraud before and during the purchase process typically centers on identity misrepresentation, concealed damage, false ownership claims, and payment manipulation.

The most effective protection combines professional representation, independent inspection, and documented verification. Ordering a Boat History Report at the start of serious negotiations provides transparency that protects both buyers and reputable sellers.

When large sums are involved, verification is not an optional step. It is a necessary safeguard.